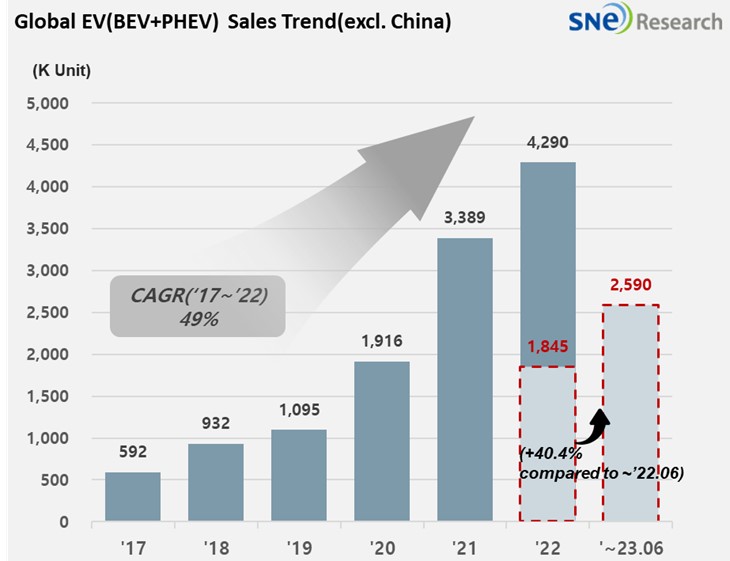

From Jan to June in 2023, Non-China Global[1] Electric Vehicle Deliveries[2]

Recorded 2.59 Mil Units, a 40.4% YoY Growth

- Tesla ranked No. 1 and Hyundai-KIA ranked 4th in the non-China EV market

From

Jan to June in 2023, the total number of electric vehicles registered in

countries around the world except China was approximately 2.59 million units,

posting a 40.4% YoY growth.

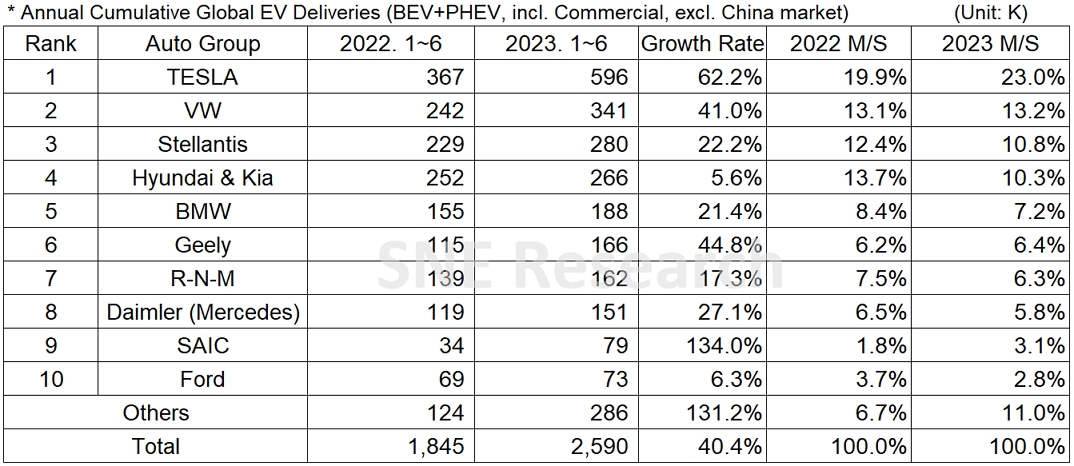

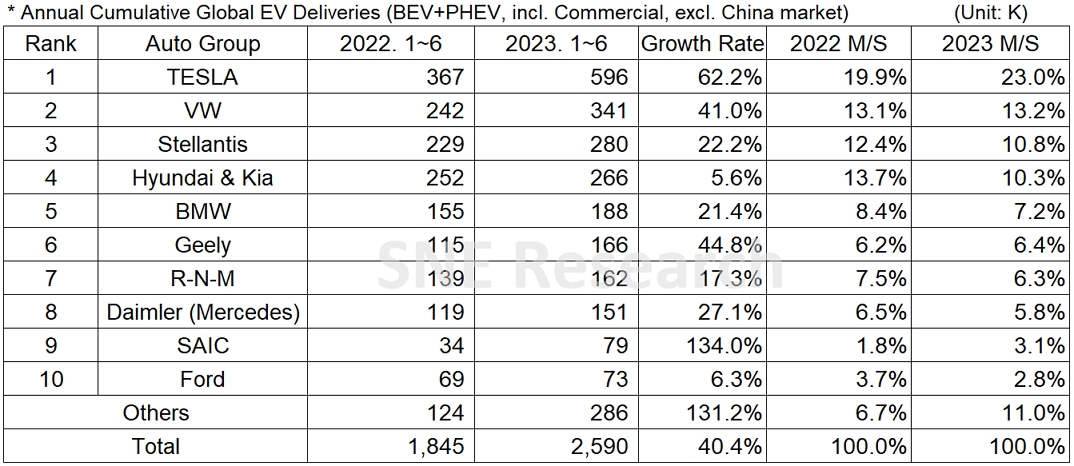

From

Jan to June 2023, if we look at the number of electric vehicles sold by OEM

groups in the non-China market, Tesla kept No. 1 position with a 62.2% YoY growth.

The growth of Tesla was based on the price-reduction strategy carried out from earlier

this year and the tax credit offered to Model 3/Y by the US Inflation Reduction

Act (IRA). The Volkswagen group, where Volkswagen, Audi, and Skoda belong to,

posted a 41.0% YoY growth, capturing the 2nd place on the list. The

growth of VW Group was driven by steady sales of Audi E-Tron line-up including

ID.4, a first, non-American EV model qualified for the EV tax credit offered by

the US government. The 3rd place was occupied by the Stellantis

Group supported by solid sales of both BEV and PHEV such as Fiat 500e and Jeep

Wrangler 4xe.

(Source:

Global EV & Battery Monthly Tracker – July 2023, SNE Research)

Hyundai-KIA Motor Group posted a 5.6% YoY growth led by IONIQ 5, EV6, and Niro. With the group breaking the profit record in the Q2 again, the launch of KONA(SX2) Electric and EV9, and the global sale of IONIQ 6 are expected to lead the group to possibly achieve record-high earnings. The SAIC Group, a strong player in the Chinese domestic market, safely entered the top 10 on the list with a triple-digit growth, based on solid sales of MG-4, MG-5, ZS, and HS models.

Hyundai-KIA Motor Group posted a 5.6% YoY growth led by IONIQ 5, EV6, and Niro. With the group breaking the profit record in the Q2 again, the launch of KONA(SX2) Electric and EV9, and the global sale of IONIQ 6 are expected to lead the group to possibly achieve record-high earnings. The SAIC Group, a strong player in the Chinese domestic market, safely entered the top 10 on the list with a triple-digit growth, based on solid sales of MG-4, MG-5, ZS, and HS models.

(Source: Global EV & Battery Monthly Tracker – July 2023, SNE Research)

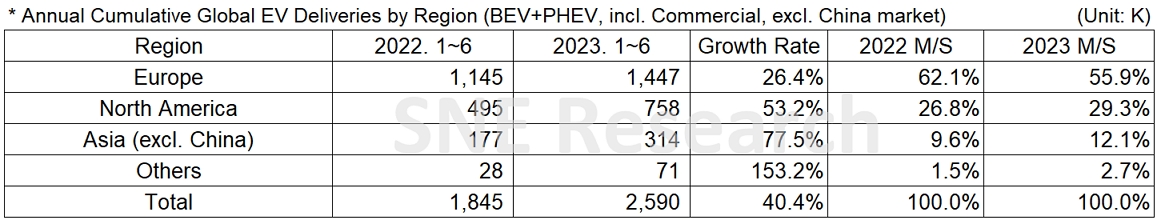

Major

Chinese EV makers such as BYD and MG have been already qualified in the Chinese

market and secured their shares in the domestic market. Taking advantages of

their vehicle safety, quality, and price competitiveness, they have been trying

to make inroads into the global market. In the European and Asian (excl. China)

regions, where those Chinese EV makers are expected to enter into, the EV

deliveries are forecasted to continue its upward trajectory.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period